Amazon.com: Taxable Supplies and Their Consideration in European VAT: With Selected Examples of the Digital Economy (IBFD Doctoral Series Book 46) eBook : Kollmann, Jasmin: Kindle Store

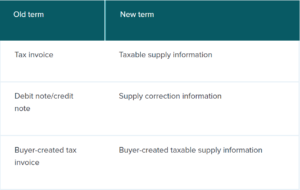

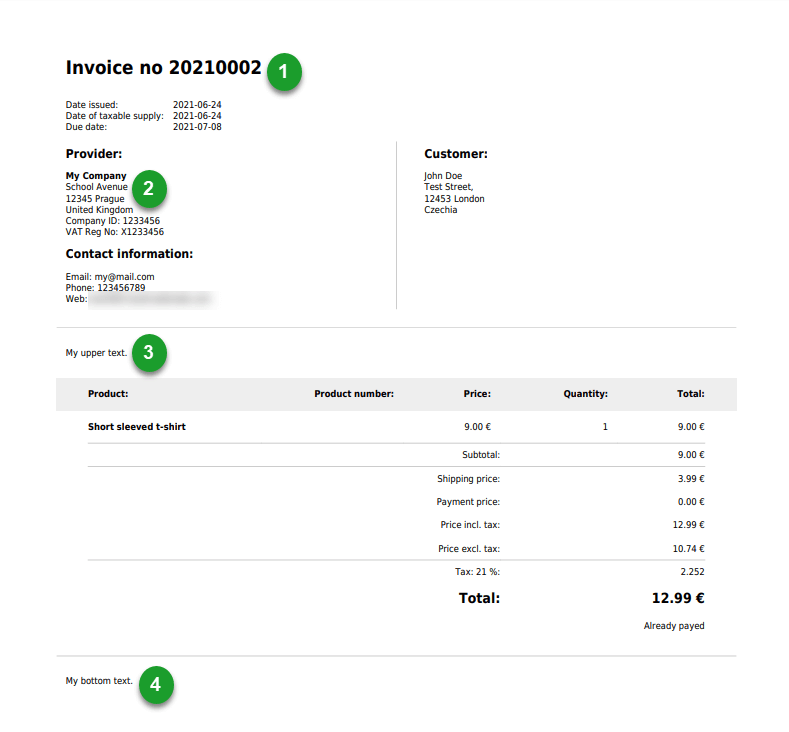

Leveraging the new taxable supply information requirements | Tax Alerts - April 2023 | Deloitte New Zealand

Leveraging the new taxable supply information requirements | Tax Alerts - April 2023 | Deloitte New Zealand

Tax Master - Have a more clear idea about GST and GST Act!😊 Know what you should & shouldn't pay under GST👍🏻 | Facebook